Momentum Builds for Sellers as Demand Strengthens Across Greater Phoenix

- Brad Daniels

- Dec 15, 2025

- 6 min read

Momentum Builds for Sellers as Demand Strengthens Across Greater Phoenix

Once again, the trend over the past week has been strongly favorable to sellers across Greater Phoenix. Demand continues to improve while supply is declining, creating a clear shift in market momentum. For the second week in a row, green circles outnumber red circles by a wide margin—15 to 3. The average change in the Cromford® Market Index (CMI)* over the past month is now +8.6%, up notably from +6.4% last week, reinforcing the strengthening seller-side trend.

Where Sellers Are Gaining Ground

The cities leading the move in favor of sellers include Peoria, Queen Creek, Fountain Hills, Tempe, Chandler, Gilbert, and Maricopa. These markets are seeing improving demand relative to supply, a dynamic that is helping sellers regain leverage after a softer stretch earlier in the year.

On the flip side, Paradise Valley remains the leading city improving for buyers, with its CMI down 4% over the last month. However, this decline is far less dramatic than the 11% drop seen last week, and the market there appears to have largely stabilized with minimal change over the past three weeks. The other two buyer-favoring cities—Avondale and Surprise—declined by 2% or less, suggesting only mild buyer-side advantage.

Big Cities vs. Secondary Markets

Among the 18 largest cities, we now have:

9 seller’s markets (including the three largest: Phoenix, Scottsdale, and Mesa)

3 balanced markets

6 buyer’s markets

This places exactly half of the major cities in seller-favoring territory—a notable shift from earlier in the year.

Conditions are less robust in the secondary cities, where we currently see:

3 seller’s markets

1 balanced market

8 buyer’s markets

Addressing the “Investor Doom” Narrative

On December 10, it was time to revisit another claim of impending market trouble—specifically, the idea that investors are “giving up” and flooding the market with unwanted supply.

At least in Greater Phoenix, the data does not support this view.

Investor purchases have actually been rising modestly, with investors accounting for 13.8% of all transactions as of October. That’s the highest share since 2023 and slightly above the range seen between 2014 and 2020. While investor activity surged during COVID (peaking around 19–21%), it settled back into the 13–14% range after mid-2022, and has stayed there ever since. In short, investors have not exited the market. If anything, they’re buying slightly more, not less.

What About iBuyers?

One notable change is the dramatic pullback by iBuyers such as Opendoor and Offerpad. In October, they accounted for just 0.3% of transactions, down from a peak of 5.7% in 2021. Their current market share is negligible, and there is no evidence that they are flooding the market with listings. Given their unique business model, they’re best viewed separately from traditional investors.

Rentals Aren’t Flooding the Market Either

There’s also little indication that former rentals are being listed for sale in unusually high numbers. While we saw an uptick in former short-term rentals entering the market earlier in 2024, that trend has since faded. In fact, the holiday rental market has shown improvement in the second half of 2025, with year-over-year gains in both occupancy and revenue per night. Long-term rentals, meanwhile, remain largely stable.

The Bottom Line

If the market were truly flooded with unwanted inventory, we would see it reflected in the data—and the balance would shift toward buyers. Instead, we’re seeing the opposite. Market conditions are steadily moving in favor of sellers, even though we remain well short of an overheated environment.

As we head into January, a new seasonal trend may emerge, but it’s unlikely to have anything to do with investors exiting the market. For now, the data continues to indicate gradually strengthening seller conditions across much of Greater Phoenix.

*Cromford Market Index™ is a value that provides a short-term forecast for the balance of the market. It is derived from the trends in pending, active, and sold listings compared with historical data over the previous four years. Values below 100 indicate a buyer's market, while values above 100 indicate a seller's market. A value of 100 indicates a balanced market.

Fed Turns More Dovish as Rates, Inflation, and Jobs Re-Align

The Fed cut short-term interest rates for the 3rd time in 2025, admitted that the BLS jobs numbers were probably “overstated,” and announced the resumption of short-term asset purchases — all good news for bond yields (and by extension, mortgage rates).

“Core” PCE moved lower in September. This really was the big one. If we could get a ‘tame’ PCE report, the path would be relatively straightforward for the Fed to cut rates. While “headline” annual PCE did climb to +2.8% YoY in September (from +2.7% in August), “core” PCE [the Fed’s preferred inflation gauge] moved in the opposite direction (+2.9% YoY → +2.8% YoY).

Importantly, “shelter” costs (rent + owner’s equivalent rent) rose just 0.15% month-over-month (or +3.7% YoY).

Job openings JOLTed the market. We received the September (7,658,000 job openings) and October (7,670,000) data simultaneously. Because the September increase (+431,000) was the largest we’ve seen in years, it initially shocked the market—could it derail the Fed rate cut? But the Hires Rate (3.2%) was tied for a decade low, and the Quits Rate (1.8%) was the lowest seen since May 2020.

Actual jobs are more important than job openings, and the Hires & Quits rates still suggest a very cautious labor market — where employers are reluctant to hire OR fire, and employees lack the confidence (or monetary incentives) to jump ship.

Fed cut rates for the 3rd time in 2025. Three voters dissented (two wanted no cut, one wanted -50 bps). Overall, Fed members concluded that the downside risks to employment outweighed the upside risks to inflation. The new target range for the Federal Funds Rate is 3.50%-3.75%, which is 175 basis points (1.75%) below where the Fed Funds Rate peaked in 2024 (5.25%).

Notably, the Fed also announced that it would begin buying short-term Treasuries (initial target: $40B/month) to keep bank reserve balances “ample” and keep the Fed Funds Rate within the target range. That should be positive for treasury yields and, by extension, mortgage rates.

Unless something dramatic happens in the next 45 days, the Fed will probably do nothing at the January 28 meeting. The Fed Funds Rate futures market currently assigns a 24% probability to a rate cut at that meeting.

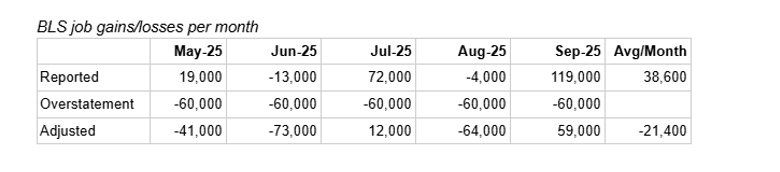

Powell admits that the BLS jobs numbers are likely “overstated”. This was quite extraordinary: the Fed Chair said he believes problems with the birth/death model likely result in the BLS jobs numbers being overstated by about 60,000/month. Since May, reported job growth has averaged 40,000 per month. Removing the overstatement would bring that to -20,000/month.

Bond and Mortgage Market

Fed week is always interesting. This one was particularly volatile. We had the tame PCE report, followed by the somewhat concerning (for the bond market) JOLTs report. Expectations were building for another “hawkish cut” — where the Fed cuts rates, but then pours water on future cuts. Instead, Powell’s commentary was almost dovish!

Net result: Yields on the 10-year UST are back near 4.1%, and average 30-year mortgage rates stand at 6.22%, according to Freddie Mac’s weekly PMMS survey.

Note: After the rate cut on Oct 29, the Fed Funds Rate policy range is now 3.50–3.75%. The probabilities below are sourced from the CME Group website and are implied by the Fed Funds Rate futures market.

January 28 FOMC Meeting: 76% probability that the Fed does nothing; only a 24% probability of a 25 bps rate cut.

March 18 FOMC Meeting: 51% probability that the Fed Funds Rate target range is kept at 3.50–3.75%. In other words, no cut at either the January or March FOMC meetings. 41% probability that rates will be 25 bps below current levels, which implies a rate cut at either the January or March meetings, but not at both.

They Said It

A series of quotes from Jerome Powell, Federal Reserve Chairman, after the decision to cut rates on December 10:

“We think there’s an overstatement in these [BLS jobs] numbers…It’s a complicated, unusual, and difficult situation, where the labor market is also under pressure, where job creation may actually be negative.”

Regarding the January 2026 FOMC meeting: “I could make a case for either side. [We’ll have to] wait and see how the economy evolves…I don’t think a rate hike [in January is anyone’s base case at this point.”

Market in a Minute

Housing

Seller momentum strengthened again as demand improved and supply declined, with seller-favoring markets outnumbering buyer-favoring markets 15 to 3.

Market conditions continued to accelerate, with the average Cromford® Market Index (CMI) change over the past month rising to +8.6%, up from +6.4% last week.

Large markets tipped toward sellers, including Phoenix, Scottsdale, and Mesa, along with substantial gains in Peoria, Queen Creek, Fountain Hills, Tempe, Chandler, Gilbert, and Maricopa.

Economy

The Fed cut rates by another 25 basis points, marking the third cut in 2025, lowered the Fed Funds target range to 3.50%–3.75%, and signaled greater concern about employment risks than inflation.

Inflation data gave the Fed cover to ease: Core PCE (the Fed’s preferred gauge) moved lower to 2.8% YoY, while shelter costs rose just 0.15% month-over-month, reinforcing the cooling inflation narrative.

Labor market weakness is more apparent beneath the surface: Chair Powell acknowledged that ~60,000 jobs per month may overstate BLS jobs data, while low hiring and quit rates point to a cautious, slowing job market.

Weather (It couldn't be more perfect)

Thank you for reading. If you found this information useful, Brad would be happy to answer your real estate questions and help you navigate the Arizona market with confidence. (602) 679-1025 brad@homeselleraz.com #CallBradToSellYourPad

Comments